Current Benchmark Issues of the Federal Government

Conventional Securities

| Security | Maturity | Coupon | Outstanding | Last Issuance | ISIN |

|---|---|---|---|---|---|

| Schatz | 16.09.2027 | 1.90% | 5.0 € bn | 15.07.2025 | DE000BU22106 |

| Bobl | 10.10.2030 | 2.20% | 5.0 € bn | 08.07.2025 | DE000BU25059 |

| Bund10 | 15.08.2035 | 2.60% | 6.0 € bn | 02.07.2025 | DE000BU2Z056 |

| Bund30 | 15.08.2056 | 2.90% | 13.5 € bn | 16.07.2025 | DE000BU2D012 |

Green Securities

| Security | Maturity | Coupon | Outstanding | Last Issuance | ISIN |

|---|---|---|---|---|---|

| Bobl/g | 12.04.2029 | 2.10% | 6.5 € bn | 17.06.2025 | DE000BU35025 |

| Bund/g10 | 15.02.2035 | 2.50% | 3.0 € bn | 08.04.2025 | DE000BU3Z047 |

| Bund/g30 | 15.08.2053 | 1.80% | 12.0 € bn | 20.05.2025 | DE0001030757 |

Schatz = Federal Treasury note, Bobl = Federal note, Bund10 = 10-year Federal bond, Bund30 = 30-year Federal bond, Bobl/g = green Federal note, Bund/g10 = 10-year green bond, Bund/g30 = 30-year green bond

Types of Federal Securities

Federal Securities by Remaining Maturity

Federal securities offer a suitable solution for almost every investment horizon thanks to the wide range of different remaining maturities.

- In the money market segment, the Treasury discount paper (Bubill) are issued with a term of 12 months and subsequently reopened several times as required.

- The capital market offering starts with Federal Treasury notes (Schatz) with a maturity of 2 years.

- Federal notes (Bobl) are issued with a maturity of 5 years.

- Federal bonds (Bund) have original maturities of 7, 10, 15 and 30 years.

- The first 10-year green Federal bond was issued in 2020. Further green Federal securities (Green) in the classic 5, 10 and 30-year maturity segments have since followed.

Issuance & Outstanding Volume

All Federal securities are placed as single issues, generally by auction. Syndicates are used for placements only selectively and rarely.

In particular, conventional Federal securities in the capital market segment are issued in high volumes at the time of the new issue, which are subsequently increased to around € 15 bn to over € 30 bn in some cases by means of several increases. On the one hand, the increases are intended to ensure high liquidity of the securities in the secondary market. On the other hand, the Federal government is taking account of its ability to deliver futures contracts on the highly liquid derivatives market, which is important for many investors, and its important role on the repo market, which is also liquid.

Issuance History and Progress

Current year vs. previous year

Issuance volumes incl. reopenings in own holdings and syndicates carried out (excl. planned). Bund 10 includes 10-year, 7-year and 15-year Federal bonds. Green Federal securities are only shown from their announcement in the week before their auction.

Issuance results of Federal securities

At year-end 2024, around 66% of the Federal government's debt portfolio consisted of Federal bonds, with 10-year bonds accounting for a share of 33%. They represent by far the most important financing instrument for the Federal government.

In line with their short maturities of 12 months, the monthly Treasury discount paper have a relatively short financing effect and thus, despite accounting for a high share of the issuance volume, only accounted for around 6 % of the outstanding volume of all Federal securities.

Green Federal securities meanwhile account for around 4 % of the outstanding Federal debt.

Shares of Federal Securities in Total Volume Outstanding

Features

Capital Market Instruments

Key characteristics of most Federal securities are their fixed maturities and fixed nominal interest rates - for example, Federal Treasury notes, Federal notes and Federal bonds and their green twins.

Inflation-linked Federal securities, on the other hand, offer a fixed real coupon. Nominal interest and redemption are linked to an inflation index for the euro area.

All Federal securities with an original term of more than one year are being listed on the stock exchange. Interest is calculated using the standard actual/actual methods in accordance with ICMA.

Money Market Instruments

Money market instruments - BUBILL with maturities of 12 months - are discount papers. After their issuance, they can be bought and sold on banking business days during their short maturity. Interest is calculated in accordance with ICMA actual/360.

All Federal securities are issued without certificates in the form of uncertificated securities. All Federal securities have in common that they are eligible as cover funds, are safe for borrowers and are eligible for central bank borrowing. Repayments are always made at par; in the case of inflation-linked Federal securities, at par adjusted for inflation indexation. There is no provision for early redemption through cancellation or drawing by the issuer. The denomination is € 0.01.

Significance

- Around the world, yields on Federal securities are regarded as a benchmark for bonds from other issuers in the euro area - both sovereigns and corporates.

- Large international investors invest in Federal securities in particular if they wish to invest part of their funds in euros.

- Federal securities are preferred as collateral for short-term interbank lending.

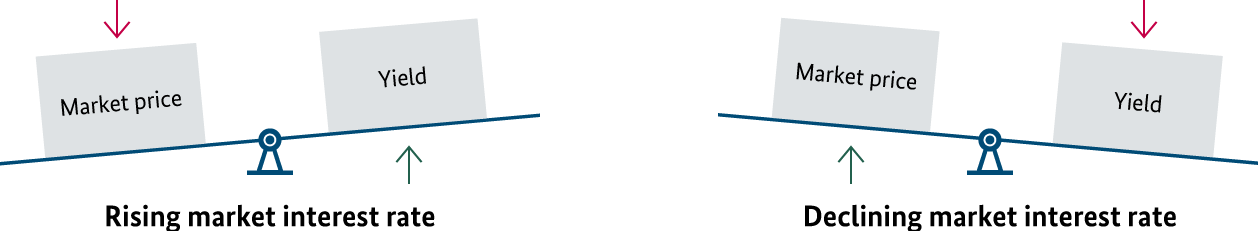

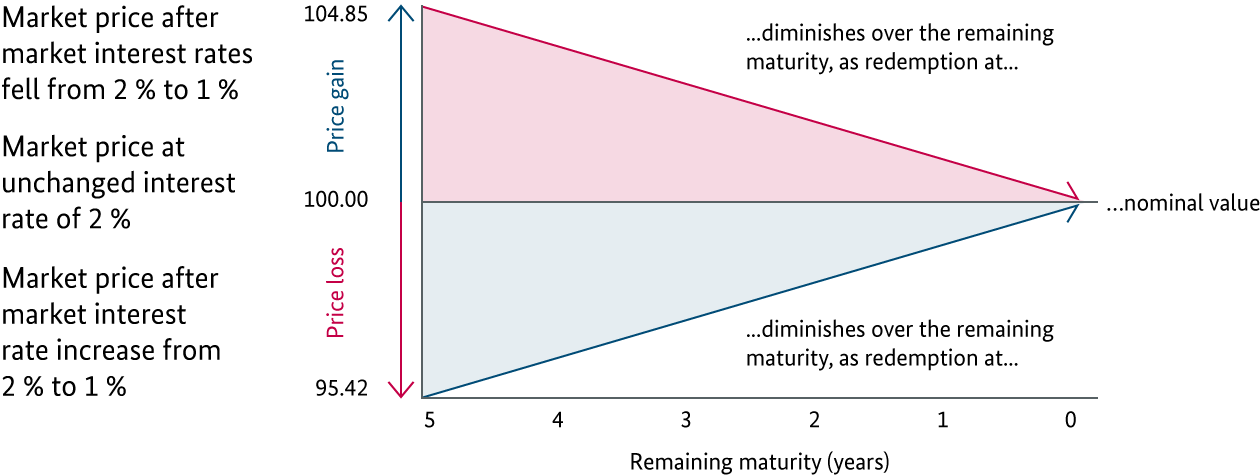

- Federal securities are used to manage interest rate risks, e.g. by banks.

- Only Federal securities can be used to supply the most important euro interest rate contracts (futures) on the futures market.

- Federal securities are an essential instrument for the implementation of monetary policy in the euro area.