Only members of the Bund Issues Auction Group may purchase Federal securities directly as part of the auction process. The Deutsche Bundesbank's Bund Bidding System (BBS) serves as the technical platform for these auctions, which are also known as tenders.

Submission of Bids

The minimum bid for Federal securities during the auction process must be at least € 1 mn or a whole multiple of it. In addition, the bids shall contain the price in per cent of the nominal amount at which the bidders are willing to acquire the offered Federal securities.

Bids may, in principle, be submitted at different prices or without a price indication. The prices offered must be a full 0.01 percentage points for Federal bonds and Federal notes, a full 0.005 percentage points for Federal Treasury notes and 0.00005 percentage points for Treasury discount paper.

Allocation & Retention Quote

The Federal government uses a multi-price auction process, i.e. bids accepted by the Federal government are allocated at the price quoted in the respective bid and are not settled at a single price. Bids that are above the lowest accepted rate will be fully allocated, while bids that are below the lowest accepted rate will not receive an allocation. Bids without a price indication will be allocated at the weighted average price of the accepted price bids. The Federal government reserves the right to reject all bids as well as to repair both the bids at the lowest accepted price and the bids without price indication, i.e. to allocate only a certain percentage.

In general, the Federal governement withholds a certain nominal volume at each auction (retention quote), which can be gradually released to the market after the tender process as part of secondary market activities. The amount of the retention quote varies from auction to auction, but has been below 20 % of the issuance volume on average since 2006:

| Retention quote | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|---|

(accum., in % of auction volume) | 21.5 | 17.0 | 17.0 | 20.3 | 17.1 | 20.8 | 22.1 | 19.4 | 20.7 | 21.5 | 18.4 |

Auction Dates

- Placements of Treasury discount paper (money market) are regularly carried out on Mondays.

- Federal Treasury notes and Federal notes are always issued on Tuesdays.

- The auctions for nominal-interest Federal bonds with a maturity of 7 years or more are always held on Wednesdays.

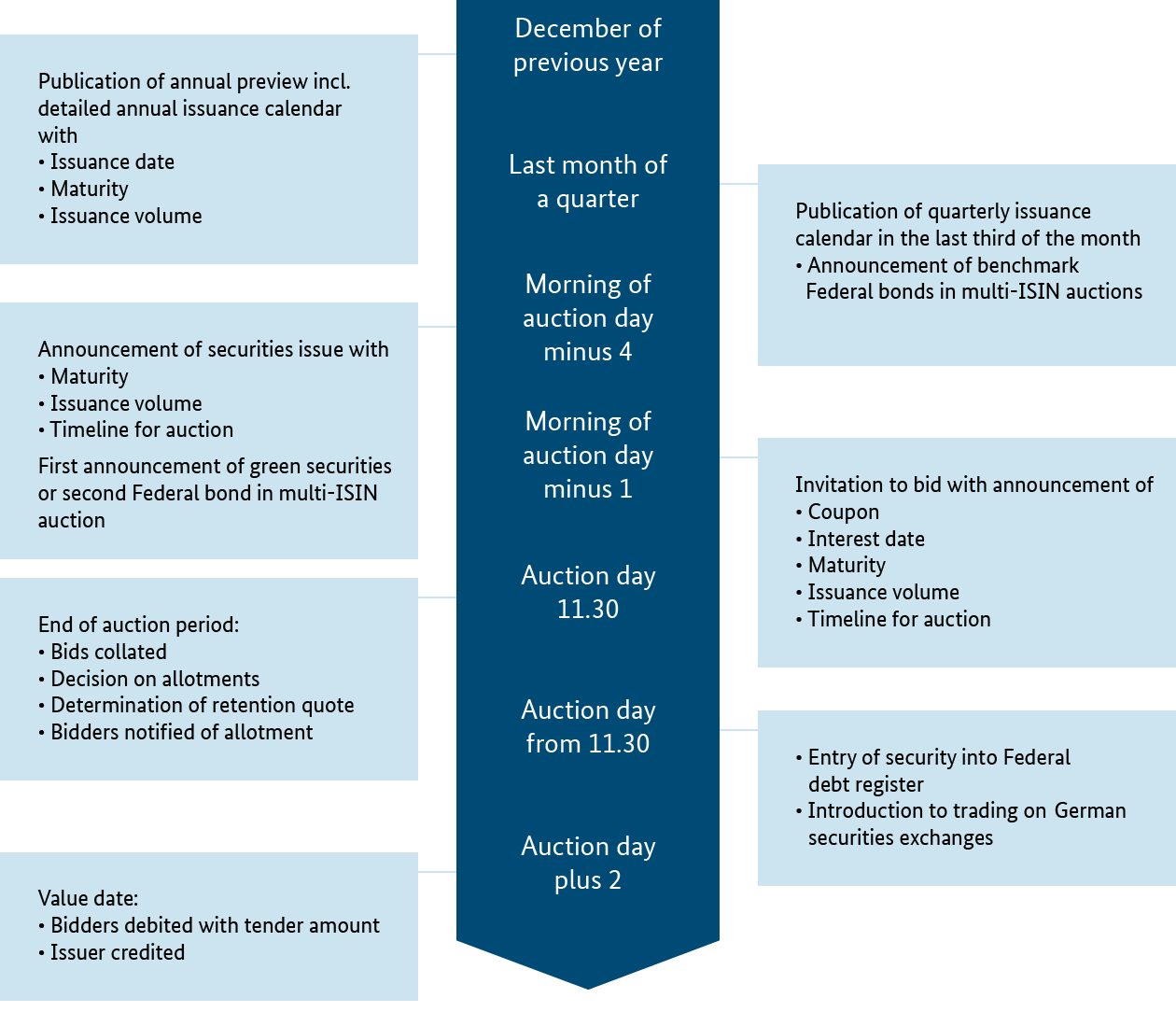

From 2024, auctions and multi-ISIN auctions will be announced four bank business days before the auction date by press notice. The Finance Agency and Deutsche Bundesbank will announce the issue volume and the maturity of the securities intended for issue in this press notice. For the first time, the green and multi-ISINs not yet published in the quarterly calendars are also specified.

One day before the auction, the coupon and interest date are announced in the invitation to bid, which is also published as a press notice.

On the auction day itself, members of the bidding group can submit their bids for the auction digitally via the BBS from 8:00 a.m. to 11:30 a.m. CET. The allocation decision will be made by the Finance Agency immediately after the end of the bidding period and transmitted to the bidders via the BBS. The auction result will then be published via news information services and this website.