Inflation-linked Federal Securities in Circulation

Four inflation-linked Federal securities with a total volume of € 66.25 bn are currently still outstanding: three bonds with original maturities of around 10 years and one 30-year bond.

| Bond | Maturity | Coupon | Outstanding | Last Issuance | ISIN |

|---|---|---|---|---|---|

| Total volume | 66,250 € mn | - | |||

| 2021 (2033) Bund/€i | 15.04.2033 | 0.10% | 10,650 € mn | 10.10.2023 | DE0001030583 |

| 2015 (2046) Bund/€i | 15.04.2046 | 0.10% | 14,250 € mn | 10.10.2023 | DE0001030575 |

| 2015 (2026) Bund/€i | 15.04.2026 | 0.10% | 19,200 € mn | 07.02.2023 | DE0001030567 |

| 2014 (2030) Bund/€i | 15.04.2030 | 0.50% | 22,150 € mn | 05.04.2022 | DE0001030559 |

Reference Index & Indexation Coefficients

The inflation indexation for both nominal value and coupon payments is based on the unrevised Harmonised Index of Consumer Prices (HICP) of the euro area (total index excluding tobacco). This is calculated monthly by the Statistical Office of the European Union ("Eurostat") and published on its website.

The indexation coefficients are computed with a time delay by linear interpolation of the montly values of the reference index.

Rebasing reference index

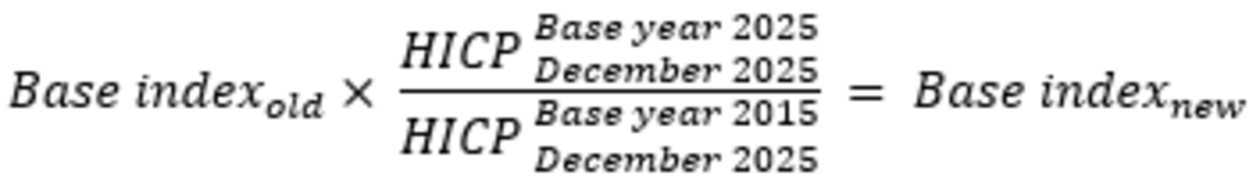

To reflect the conversion of the reference year for the HICP to 2025=100, the base-indices of all outstanding inflation-linked securities will be adjusted per 02.03.2026 by using the following key:

The HICP value for December 2025 based on 2015 = 100 was announced as 128.89. The corresponding value based on 2025 = 100 was published by Eurostat on 25 February 2026: 100.61. The new rebased reference index, the newly calculated base indices for each ISIN and the unchanged index ratios are now available for download in a new Excel file.