Targets and Framework

With green German Federal securities, market participants with a wide range of investment horizons are offered a green and transparent investment alternative with a first-class credit rating.

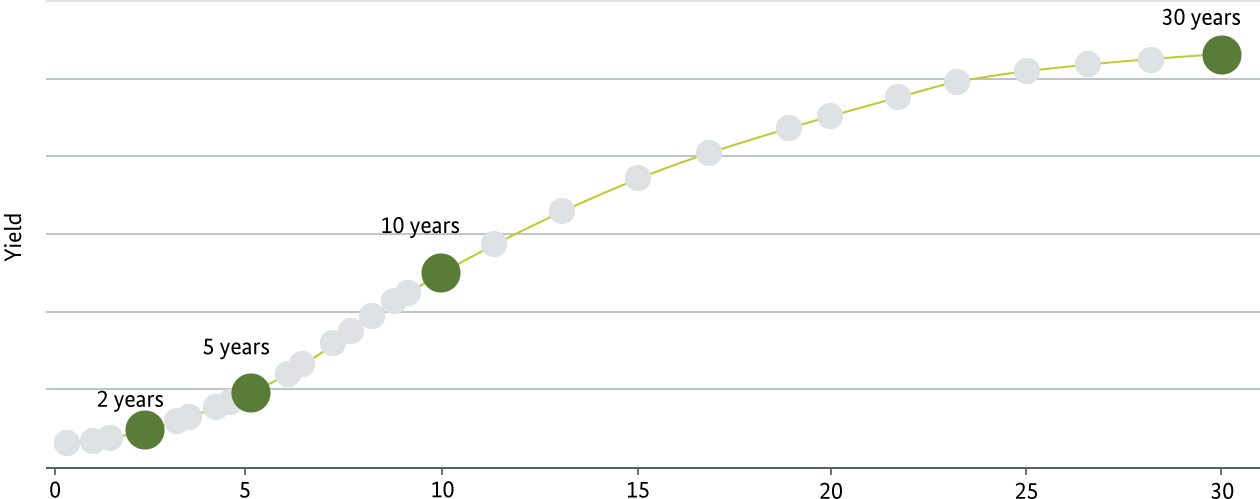

With a focus on benchmark maturities, Germany established a interest rate reference for the green euro financial market. The twin concept developed by the German Finance Agency also allows market participants to directly compare green and conventional twin bonds and to identify the yield difference – the so-called greenium – at a glance. Germany strengthens and supports the market for green and sustainable investments through this price transparency.

Under the first green framework from August 2020, the federal government has successfully issued nine green federal securities in the years 2020 to 2025. Green federal securities issued from 2026 onwards will be subject to the second version of the framework. In addition to new issues and increases in existing issues, this may also include increases in green federal securities issued under the first version of the framework.

The revised framework 2026 updates and expands the 2020 framework, while retaining the core features of green federal securities. Both frameworks are aligned with the ICMA Green Bond Principles. The update to the framework takes into account the further development of the federal government's goals in national and international climate, environmental, and nature conservation, as well as the further development of market standards. Transparency regarding the project evaluation and selection process is increased and reporting is improved.

The Green Bund Curve